Understanding Closing Costs: What You Need to Know

A complete guide with real examples built into each topic (LE/CD)

Closing costs are one of the most misunderstood parts of buying a home. They affect your total cash-to-close and vary depending on loan type, location, and timing. This guide explains each cost and shows you exactly how they look on a Loan Estimate (LE) and Closing Disclosure (CD).

📄 Before We Begin: Two Key Documents You Will Receive

📌 Loan Estimate (LE)

Provided within 3 days of applying

Shows your estimated rate, fees, and closing costs

📌 Closing Disclosure (CD)

Delivered 3 days before closing

Shows your final and exact cash-to-close

Your LE is the preview —

Your CD is the final invoice.

📍 Sample Buyer Scenario Used for All Examples

Home Price: $450,000

Loan Amount: $360,000 (20% down)

Interest Rate: 6.25%

Loan Type: Conventional 30-Year Fixed

Closing Date: March 15, 2025

Location: Cumming, GA

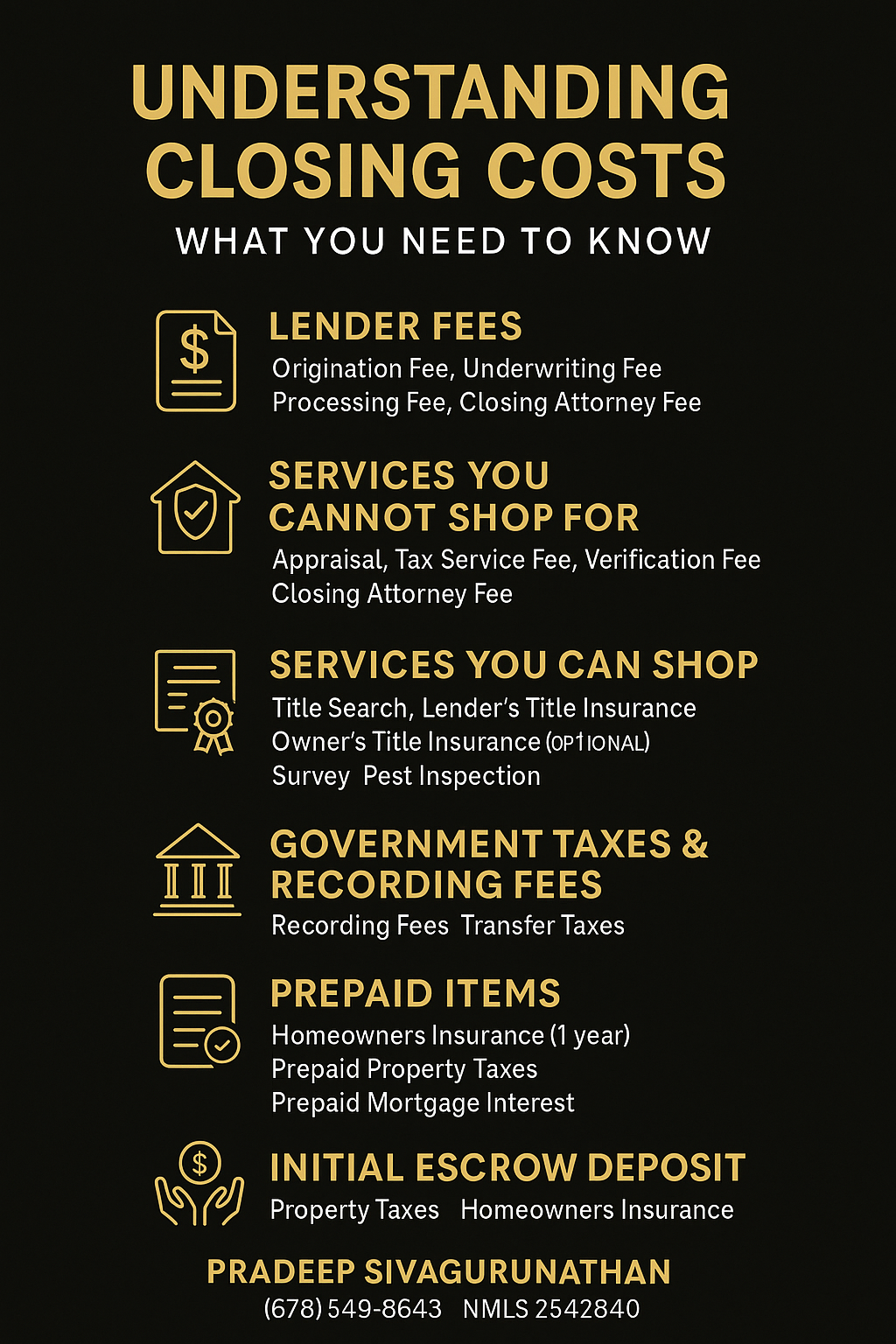

⭐ 1️⃣ Lender Fees (Origination Costs)

These are fees charged by your lender to process and approve your mortgage.

💵 Example from LE / CD:

| Lender Fee | Amount |

|---|---|

| Origination Fee | $1,295 |

| Underwriting Fee | $995 |

| Processing Fee | $650 |

| Credit Report | $45 |

| Flood Certificate | $12 |

| TOTAL LENDER FEES | $2,997 |

These will appear identically (or close) on both the LE and CD.

⭐ 2️⃣ Services You Cannot Shop For

These are required services selected by the lender.

💵 Example from LE / CD:

| Required Service | Amount |

|---|---|

| Appraisal | $650 |

| Tax Service Fee | $95 |

| Verification Fee | $45 |

| Closing Attorney Fee | $650 |

| TOTAL NON-SHOPPABLE FEES | $1,440 |

⭐ 3️⃣ Services You Can Shop For

These are fees you can shop, including title services and inspections.

💵 Example from LE / CD:

| Shoppable Service | Amount |

|---|---|

| Title Search | $350 |

| Lender’s Title Insurance | $1,250 |

| Owner’s Title Insurance (Optional but Recommended) | $750 |

| Survey | $475 |

| Pest Inspection | $125 |

| TOTAL SHOPPABLE COSTS | $2,950 |

📌 Owner’s Title Insurance protects YOU, ensuring no one can claim ownership later. It appears on both LE and CD under “Services You Can Shop For.”

⭐ 4️⃣ Government Taxes & Recording Fees

These fees come from state and county offices.

💵 Example from LE / CD:

| Government Fee | Amount |

|---|---|

| Recording Fees | $125 |

| Transfer Taxes | $1,350 |

| TOTAL GOVERNMENT FEES | $1,475 |

Georgia, like many states, charges transfer tax and intangible tax on the loan amount.

⭐ 5️⃣ Prepaid Items (Your Expenses Paid in Advance)

These are your future costs collected upfront, not lender fees.

💵 Example from LE / CD:

| Prepaid Item | Amount |

|---|---|

| Homeowners Insurance (1 year) | $1,800 |

| Prepaid Property Taxes | $850 |

| Prepaid Mortgage Interest | $675 |

| TOTAL PREPAIDS | $3,325 |

Prepaid interest changes based on the closing date — closing at end of month reduces this amount.

⭐ 6️⃣ Initial Escrow Deposit (Reserves Held by Lender)

Lenders collect reserves to ensure tax and insurance bills are paid on time.

💵 Example from LE / CD:

| Escrow Item | Months Collected | Amount |

|---|---|---|

| Property Taxes | 3 months | $1,100 |

| Homeowners Insurance | 2 months | $300 |

| TOTAL ESCROW RESERVES | $1,400 |

⭐ 7️⃣ HOA Fees (If Applicable)

If the property is in an HOA, you may see:

💵 Example from LE / CD:

| HOA Fee | Amount |

|---|---|

| HOA Initiation Fee | $500 |

| HOA Transfer Fee | $250 |

| First Month’s HOA Dues | $150 |

| TOTAL HOA-RELATED COSTS | $900 |

These are paid at closing and depend on the HOA.

⭐ 8️⃣ Total Closing Costs Summary

All categories combined:

💵 Example from LE / CD:

| Category | Amount |

|---|---|

| Lender Fees | $2,997 |

| Non-Shoppable Fees | $1,440 |

| Shoppable Fees (incl. Owner’s Title) | $2,950 |

| Government Fees | $1,475 |

| Prepaids | $3,325 |

| Escrows | $1,400 |

| HOA Fees | $900 |

| TOTAL CLOSING COSTS | $14,487 |

⭐ 9️⃣ Cash to Close Calculation

What the buyer actually brings to closing:

💵 Example from LE / CD:

| Item | Amount |

|---|---|

| Down Payment (20%) | $90,000 |

| Total Closing Costs | $14,487 |

| Earnest Money Paid | -$5,000 |

| Appraisal Paid Upfront | -$650 |

| FINAL CASH TO CLOSE | $98,837 |

This is the number shown on the CD under “Cash to Close.”

🎯 Why This Matters

Understanding closing costs helps buyers:

Budget accurately

Avoid surprises

Compare lenders

Negotiate seller concessions

Understand their LE vs CD differences

When buyers understand how the money flows, they feel empowered and confident.

📘 Final Thoughts

Closing costs shouldn’t be a mystery. With clear explanations and real examples from the LE and CD, every buyer can walk into closing fully prepared and stress-free.

If you'd like a personalized closing cost worksheet for your buyers, I can create one based on their price range and loan type.

#ClosingCosts, #UnderstandingClosingCosts,

#HomeBuyerEducation,#HomeBuyingTips,#MortgageEducation,#LoanEstimate,#ClosingDisclosure,#LEvsCD,#CashToClose,#HomeLoanTips

Leave a Reply